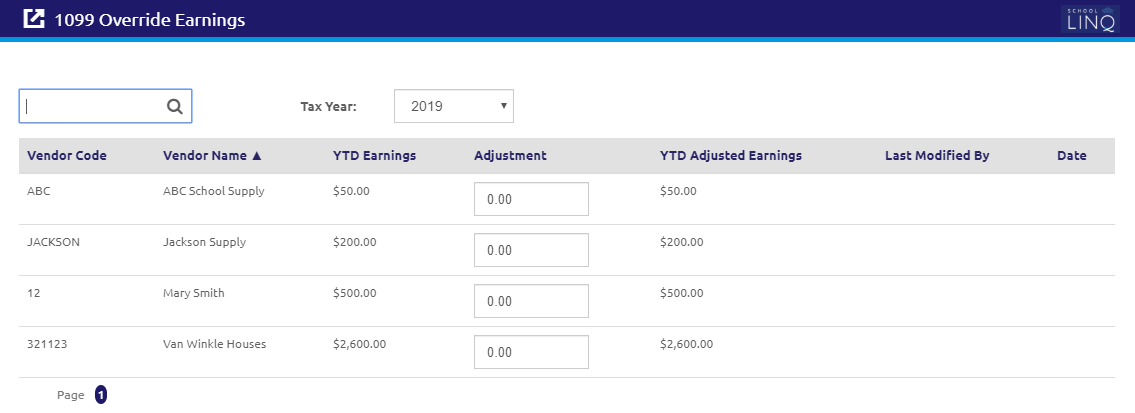

1099 Override Earnings

1099 Override Earnings allows you to adjust a vendor’s calendar year-to-date amounts for 1099 purposes only. This does not affect invoice history or ledger amounts.

- To search for a vendor, enter a Vendor Code or Vendor Name in the

field.

field. - Select a year from the Tax Year drop-down list. All vendors set as 1099 vendors in the General tab will display in the grid.

- YTD Earnings: The total amount paid to the vendor for the Tax Year selected.

- YTD Adjusted Earnings: The total that will print on the 1099 for this vendor.

- Enter the amount needed to add (or subtract) from the YTD Earnings amount in the Adjustment field.

- Click the

button.

button.

NOTE: A Reimbursement field has been added to the invoice line. The Total field will no longer include reimbursements.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021